The best ways to handle your budgeting are often the simplest ones. It shouldn’t be complicated or give you a headache, after all. The 50/30/20 rule is probably the simplest monthly budgeting method, telling you exactly how to handle your monthly costs.

There’s no need to record every single transaction to avoid overspending and leave some money in your savings each month. If you ever tried a budgeting app and gave up before you even started using it, the 50/30/20 rule might be the perfect fit for you.

What Is the 50/30/20 Rule and How It Works?

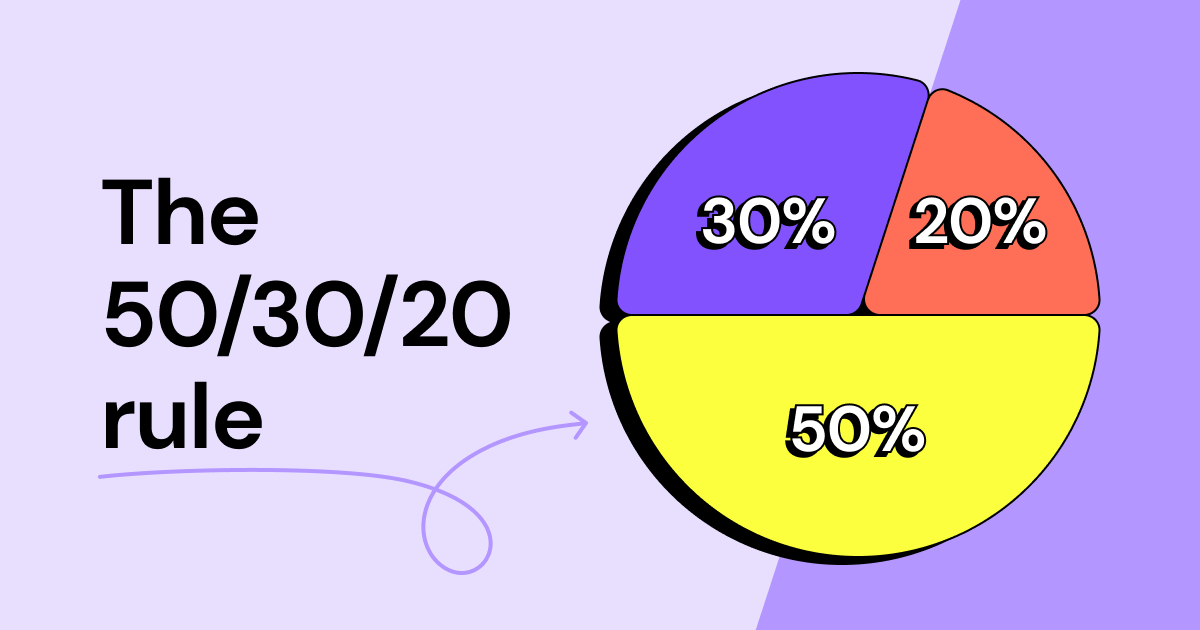

This budget management method can help you distribute your money in a simple and sustainable way. All you have to do is distribute your income into three key categories: 50% for your needs, 30% for your wants, and 20% for your savings or debt. Balancing your expenses between these three key categories can save time and help you avoid stressful digging into the details of every transaction.

If your primary objective is to save more money, this method offers an excellent way to make your spending habits more structured. It doesn’t matter if you’re trying to save up or pay off debt – this method will help you reach your financial goals faster.

The 50/30/20 rule was developed by Elizabeth Ann Warren, the former law professor and current Senator of Massachusetts. It was first described in the book “All Your Worth” from 2005, which Warren wrote with her daughter, Amelia Warren Tyagi.

After more than 20 years of financial research, Warren and Tyagi concluded that getting your finances under control doesn’t need to be complicated. Balancing your money across needs, wants, and savings goals is all you need. So, the 50/30/20 was born.

How to Use the 50/30/20 Rule to Budget Your Money

As we already explained, the rule simplifies budgeting by splitting your income (after tax) into three key categories – needs, wants, and savings or debt. Once you know how much money you can spend on each category, you’ll have a significantly easier time sticking to your budget. More importantly, you’ll be able to keep your spending in check.

Spend 50% on Your Needs

Your needs are all expenses you can’t avoid. These include:

- Food

- Rent

- Utilities

- Transportation

- Insurance

- Loan repayments

Let’s say your monthly income is $2,000 after tax. If you plan to stick to the 50/30/20 rule, you’ll allocate $1000 to your needs. However, this doesn’t have to be true for everyone. If covering your needs requires more than 50% of your monthly income, you can make some changes to reduce these expenses.

In most cases, eating healthy on a budget or changing to a different power provider can make a huge difference. There are also other tips you can try. If nothing works, then it might be time to consider more significant changes, like looking for more affordable housing.

Spend 30% on Your Wants

Once your needs are covered, 30% of your income can go toward covering your wants. These are your non-essential expenses. In other words, they’re anything and everything you decide to spend your money on, even though you can live without it if needed. These include:

- Clothing

- Eating out

- Entertainment

- Gadgets

- Streaming and gaming subscriptions

- Non-essential groceries

Following the example from above, if your monthly income is $2,000, you can spend $600 on your wants. Now, getting carried away is quite easy. If you notice that your wants cost too much, it’s a good idea to think about which of them you can cut back on. Why pay for a gym membership if you go once or twice a month?

Another essential thing to remember is that following the 50/30/20 rule doesn’t mean you can’t enjoy things. It just means being more responsible with your money and getting rid of unnecessary overspending. In case you’re unsure if something falls into your needs or wants, just ask yourself if you could live without it. If your answer is yes, it’s a want.

Put 20% Into Your Savings

Once you’ve taken care of your wants and needs, you should put the remaining 20% toward your savings goals or paying off debt. Doing this each month will certainly help you develop a more reliable savings plan. More importantly, these savings can quickly add up. If we follow the equation, you’ll save $400 each month, which is $4,800 after a year!

The Takeaway

The 50/30/20 rule is easy enough for everyone, even for homeless people, to follow without breaking a sweat. More importantly, it will definitely put you in control of your finances and help you see the big picture.

When it comes to keeping a healthy budget, every little bit helps. If you find yourself struggling to fit your income into the 50/30/20 rule, give Pawns.app a try! With our app, you can earn money by completing surveys and sharing your internet. The best part? Anyone can join, and it works worldwide. Become a part of our global community and get a $1 starting bonus by clicking the button below!